Many individuals often opt for a basic policy rather than a comprehensive one, in an attempt to reduce the premium amount. However, this may not be the best option always. For instance, if you happened to save a considerable amount by opting for a basic plan, and if you find yourself in an unfortunate incident or accident the basic plan will not cover all of your expenses. You will then have to pay for the expenses towards repairs of the car by yourself. And this amount which you spent maybe actually more than what you have saved when you opted for the basic plan. Here are tips which you can use to effectively bring down the premium amount.

Get Accurate Information About Different Policies

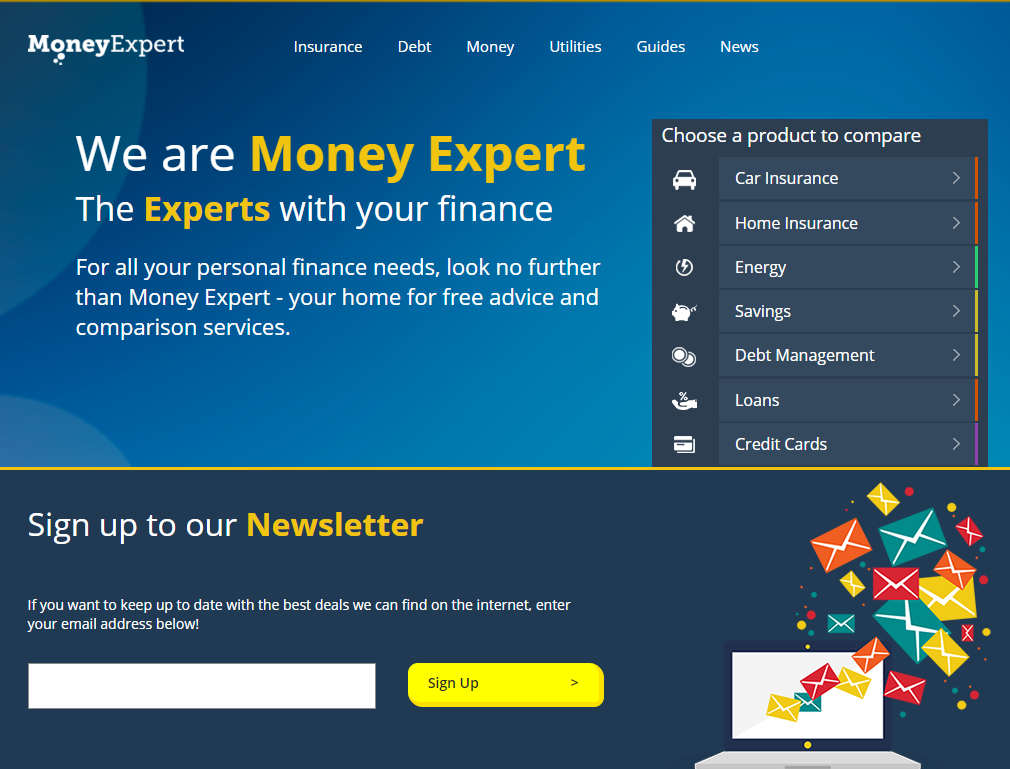

You can start off your efforts to bring down the premiums by first comparing various policies offered by different insurance companies and checking out the premium amount payable. You can do this by entering basic details about yourself in moneyexpert.com, which will then populate a list of various insurance policies of different companies with complete details about premium. Based on this information you can then make a choice and decide on the most suitable policy which you can buy to meet your specific needs.

Details About Self, Car & Claims History

The information that you will have to provide on the website will include details about yourself, such as your age gender and profession. Other details will also include the make and model of your car and records of your past claims raised with insurance companies. On the basis of this information which you have furnished the insurance companies will come up with quotes for different policies across various categories. Depending upon your preferences and their needs you can then choose the most suitable policy.

Slash Premium Costs Considerably

If you would like to bring down the premium amount payable you can then look at different options that are legally permitted. This includes the payment of premiums annually rather than making the payments monthly or quarterly. When you make annual payment will also receive the additional benefit of a trouble free method. In other words, you will not have to make frequent payments – either monthly or quarterly to keep the policy in force. When you opt for the annual payment you make one single payment which will give you the benefit of a discount in addition to keeping you free from the hassle of making reputed payments.

Carefully Consider Implications Of Voluntary Excess Amounts

You can also look at voluntary excess amounts to reduce the premium amount that you will have to pay. This needs to be exercised with great caution as it entails considerable expenses from your pocket in the event of any untoward incident or accident. What it effectively means is that you will pay lesser premiums all the time but will face the prospect of paying more money from your pocket if a claim has to be raised. It is there, therefore,d option to carefully consider the various probabilities before you opt for this.